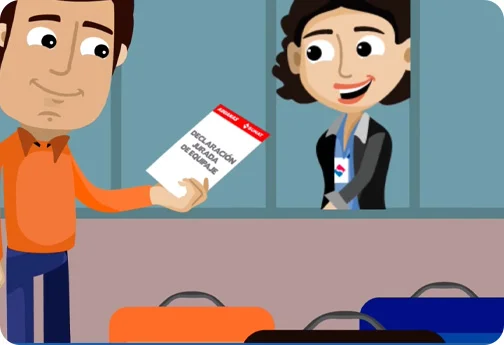

What goods or articles should you declare when entering Peru?

These are the goods and items subject to tax that you must declare by completing your Customs Declaration for Baggage and Money. You can make your declaration in the 'Procedures and Declarations' section or through the APP Welcome to Peru.

-

Baggage and/or items paying duties

- Goods or items NOT considered in the 'GOODS OR ARTICLES TAX-FREE' section up to a value of US$ 1,000 dollars, pay a 12% tax. Articles and goods with higher amounts, pay the taxes applicable to an import

-

Items excluded from the Procedure of Baggage and Household Goods

- Parts or spare parts of motor vehicles, motorcycles, mopeds or ATVs, motor homes or trailers; boats of all kinds including jet skis and aircrafts (Drones).

- Items owned by residents in border areas (subject to special regulations).

-

Restricted items

- Agricultural products

- Medical and dental equipment

- Flora and fauna

- Weapons and ammunition.

- Cultural heritage

- Others, according to specific rules.

-

Items for temporary entry

- Goods, equipment or tools that are individually identifiable, for professional or technical use, have to be placed in the process of temporary entry and a guarantee should be deposited for an amount equivalent to import duties.

- The non-resident traveler may enter sports goods for the development of adventure tourism activities, and professional equipment corresponding to foreign press without a guarantee deposit.

Videos

-

Report purchases for your business

Report purchases for your business -

APP Welcome to Peru

APP Welcome to Peru