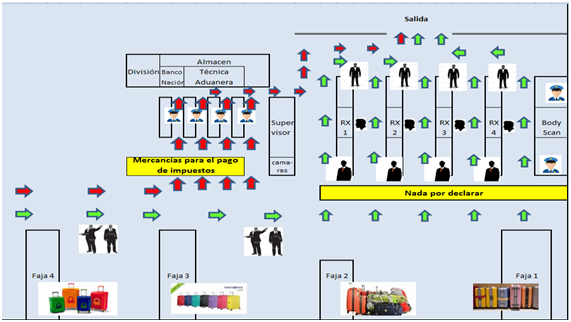

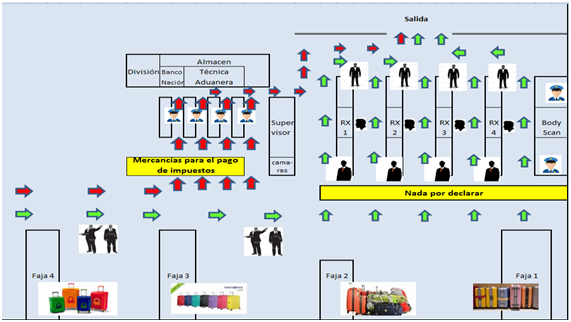

After going through immigration and picking up your baggage, you have to go through Customs control where you will find two circuits:

Green Circuit:

If your baggage is comprised of goods or articles mentioned in the list “Nothing to declare”, you do not have to submit the Baggage Declaration Form and can go to the exit through the green circuit. When choosing the green circuit it means that you declare to bring:

- Baggage and/or items free of duties.

- non-restricted or non-prohibited Items

- Currency in cash and/or negotiable monetary instruments in a total amount that does not exceed USD 10,000 or its equivalent in other currency.

Important:

Bear in mind that:

- The Customs Authority controls every person, means of transportation and items, including baggage and household goods, in accordance with General Customs Law

- Likewise, it can establish travelers or crew member’s inspection and physical inspection of their baggage, household items or clothing and items for personal use, at any moment during the control, by using technological instruments for such purpose.

Red Circuit:

If your baggage is comprised of goods or articles mentioned in the list “Goods to declare”, , you have to submit the Baggage Declaration form and can go to Customs control through the red circuit.

Before presenting to the Customs authority, you must have completed the Baggage Declaration form and marked with an "x" the corresponding category or categories according to the goods or articles you carry.

Important:

Family units (consisting of the spouse, minor children and/or parents) may file a single declaration.

Remember:

- Goods or items considered as baggage that exceed the amounts indicated in the list “Nothing to declare”, and that do not exceed US$ 1,000 (one thousand United States dollars) per trip, with a maximum of US$ 3,000 (three thousand United States dollars) per calendar year, will pay a one-off tax of 12 percent (12%) on the customs value.

- Goods that exceed this limit will pay the regular import taxes.

Goods in custody:

You may leave declared goods or articles in custody of the Customs authority when:

- You do not pay duties in that moment,

- You bring restricted items and do not have the legal requirements for entering them into the country;

- You bring goods or items not considered as baggage, which should be subject to a customs procedure other than baggage.

In these cases, you will receive a custody receipt for the goods o items, which will be used to carry out the corresponding customs procedures.